Choosing Between Self-Managed, Plan-Managed, and NDIA-Managed Funding:

A Guide for NDIS Participants

When you receive an NDIS plan, one of the key decisions is how your funds will be managed. The NDIS offers three funding management options: Self-Managed, Plan-Managed, and NDIA-Managed (also known as Agency-Managed). Each method provides unique benefits, challenges, and levels of control over how you access and utilise NDIS supports. This guide outlines each option in detail, the pros and cons, and factors to consider when selecting the best approach for your needs and lifestyle.

What Are the Funding Management Options?

NDIS participants can choose from the following funding management options, depending on their preferences, level of independence, and capacity for managing finances:

Self-Managed: You manage your own NDIS funds, paying providers directly and handling invoices.

Plan-Managed: You work with a Plan Manager, who assists in managing your NDIS budget, making payments to providers, and keeping track of your funds.

NDIA-Managed (Agency-Managed): The National Disability Insurance Agency (NDIA) manages your NDIS funding, and you are limited to using only NDIS-registered providers.

Self-Managed Funding

With self-managed funding, participants handle all aspects of their NDIS budget, from booking services to paying providers and keeping track of expenses.

How It Works

Self-management gives participants the highest level of flexibility and control. You can use both registered and unregistered providers, which means more choice in who delivers your services. Self-management also involves submitting receipts and invoices to the NDIS portal for reimbursement, so participants need to maintain accurate records.Benefits of Self-Managed Funding

Greater Choice of Providers: You have the freedom to choose both NDIS-registered and unregistered providers, expanding your options for personalised support.

Flexibility in Pricing: Self-managed participants can negotiate rates with providers, which may allow for more cost-effective service arrangements.

Increased Autonomy and Control: Managing funds independently can help you shape your plan to meet unique needs and goals.

Challenges of Self-Managed Funding

Time-Consuming: Managing funds, tracking spending, and submitting invoices can require significant time and organisation.

Record-Keeping Requirements: Self-managed participants must keep detailed records of invoices and receipts for audit purposes.

Risk of Mismanagement: Participants must stay within budget and manage funds carefully to ensure they last through the plan period.

Plan-Managed Funding

In Plan-Managed funding, a Plan Manager is appointed to oversee your NDIS budget, handle payments to providers, and keep track of spending on your behalf. This option offers a balance of flexibility and support.

How It Works

When you opt for plan management, the NDIS allocates additional funding specifically to cover the cost of a Plan Manager. Your Plan Manager takes care of payments to providers, manages invoices, and provides you with regular updates on your budget. You can use both NDIS-registered and unregistered providers with this option.Benefits of Plan-Managed Funding

Assistance with Financial Management: The Plan Manager handles all payments and bookkeeping, reducing administrative burdens.

Access to a Broad Range of Providers: You can choose both registered and unregistered providers, giving flexibility similar to self-managed funding.

No Cost to You: Plan management fees are covered by the NDIS, so you don’t have to pay out of pocket.

Challenges of Plan-Managed Funding

Potential Delays: Processing payments and invoices through a Plan Manager may introduce some delays compared to paying providers directly.

Dependent on the Plan Manager’s Quality: The quality of service and responsiveness can vary between Plan Managers, impacting your experience.

Less Financial Independence: While you have flexibility in provider choice, your Plan Manager controls the budget and payments, which may limit hands-on management.

NDIA-Managed (Agency-Managed) Funding

NDIA-Managed funding (or Agency-Managed) means the NDIS manages your funds directly, making payments only to NDIS-registered providers on your behalf.

How It Works

With this option, participants do not need to handle any payments or invoices. Instead, the NDIA automatically manages funds, and providers submit claims directly to the NDIS portal for payment. NDIA-Managed funding is a good option for participants who prefer limited involvement in the financial aspects of their plan.Benefits of NDIA-Managed Funding

Low Administrative Burden: The NDIA handles all payments, meaning no invoices or receipts need to be managed by the participant.

Budget Compliance and Protection: The NDIA ensures funds are used appropriately, helping avoid overspending and maintaining compliance.

Structured and Secure: This option provides a straightforward and reliable process with limited participant responsibility for funds.

Challenges of NDIA-Managed Funding

Limited Choice of Providers: Participants are restricted to NDIS-registered providers, which may reduce options for specialised services.

Less Flexibility in Services: Providers often charge the NDIS standard rate, which means there may be less room for negotiating service costs.

Reduced Control and Personalisation: Because the NDIA manages the funds directly, participants have less control over service arrangements and budget management.

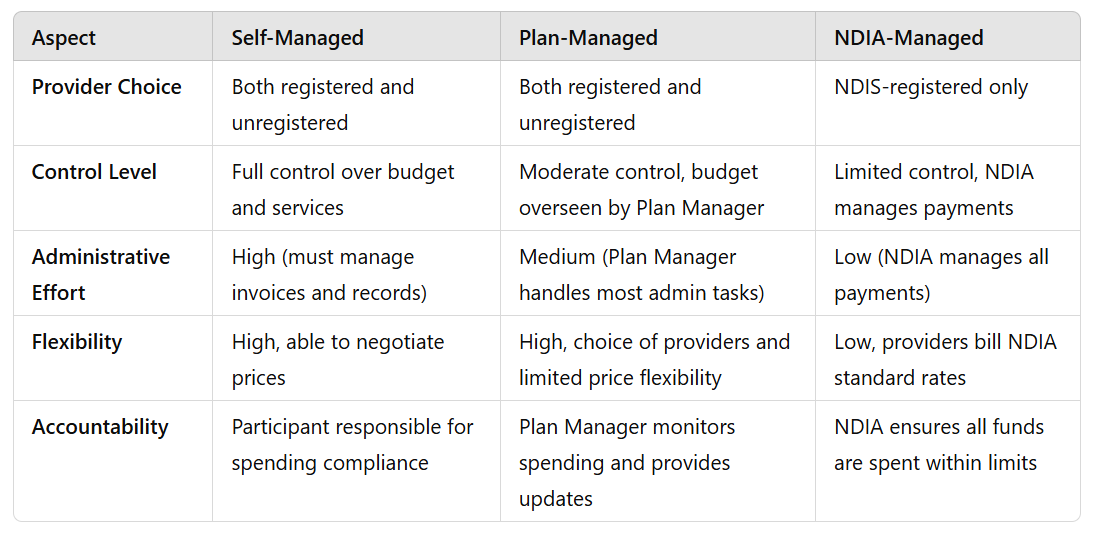

Comparing the Options: Key Differences at a Glance

How to Decide Which Option is Best for You

Choosing the right funding management option depends on your personal circumstances, preferences, and support needs. Consider the following questions:

Do I want to manage my own budget and make payments?

If yes, self-managed funding may be suitable. If you prefer some assistance, plan-managed could be better. If you want minimal involvement, NDIA-managed might be the best choice.How important is provider choice to me?

If having access to both registered and unregistered providers is essential, self-managed or plan-managed funding will offer more flexibility than NDIA-managed.Do I have time and organisational skills for managing finances?

Self-management requires handling invoices and receipts, so it may be better suited for those who have time and are comfortable with record-keeping.Do I want a balance of support and control?

Plan management offers a middle ground, giving flexibility without the full responsibility of self-management.Is financial oversight important to me?

NDIA-managed and plan-managed options provide varying levels of oversight to ensure that funds are used correctly. This can be helpful for participants who want budget protection.

Choosing between self-managed, plan-managed, and NDIA-managed funding is a key part of personalising your NDIS experience. By considering your needs for flexibility, control, and administrative support, you can select the option that best aligns with your lifestyle and goals. Remember, you can change your funding management method at any time if your needs evolve, so choose what feels best for now and revisit your options as needed.